Two House Republican leaders fired off a letter to Federal Housing Finance Agency Director Sandra Thompson on Tuesday demanding that the Biden administration eliminate its plans to make homebuyers with good credit pay more for mortgage costs to offset those who have riskier credit or else Republicans would “take action to repeal them legislatively and reconsider the parameters of FHFA’s authority.”

In January, the Federal Housing Finance Agency (FHFA) announced they would introduce “redesigned and recalibrated upfront fee matrices for purchase, rate-term refinance, and cash-out refinance loans” to change Fannie Mae’s and Freddie Mac’s single-family pricing framework.

“In January 2023, FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income (DTI) ratio above 40 percent,” FHFA noted in March. “These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or by wealth. FHFA has decided to delay the effective date of the DTI ratio-based fee by three months to August 1, 2023, to ensure a level playing field for all lenders to have sufficient time to deploy the fee.”

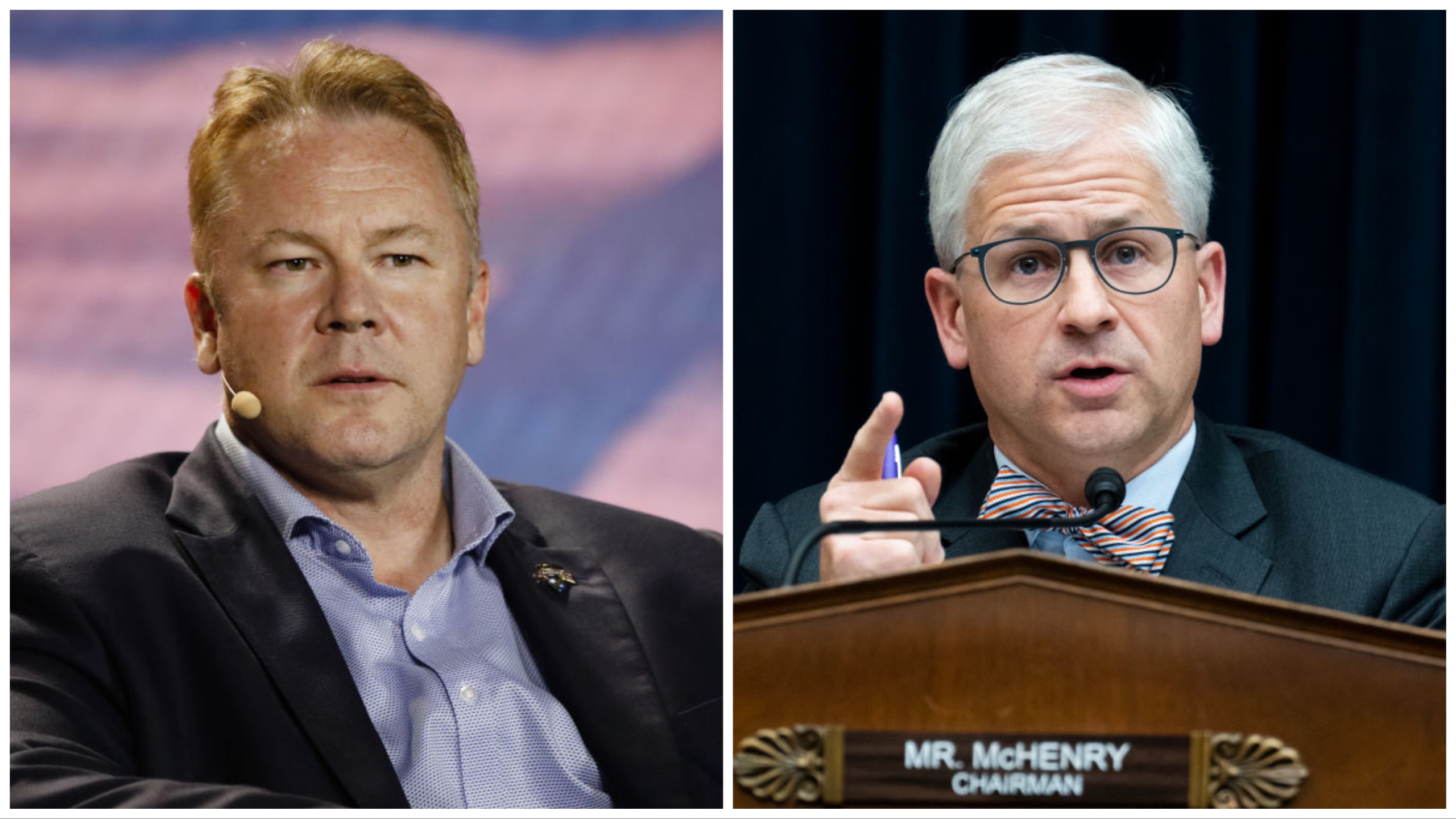

“These changes cannot be justified from a risk management perspective, and amount to a tax on all creditworthy GSE homebuyers to subsidize borrowers with riskier loans,” Financial Services Chair Rep. Patrick McHenry (R-NC) and Housing and Insurance subcommittee chair Warren Davidson (R-OH) wrote.

“These changes violate the fundamental principle of risk-based pricing, namely that lower-risk borrowers should pay lower prices for access to credit than higher-risk borrowers,” they continued. “There is no doubt that lenders will pass on the new LLPA (loan-level price adjustment) costs to borrowers, which will result in higher mortgage rates and reduced access to credit. This new tax also fails the basic test of fairness by punishing borrowers who act responsibly, and will in turn incentivize homebuyers to reduce their down payments and carry additional debt.”

Mortgage rates are determined by interest rates set by the Federal Reserve as well as the loan-level price adjustment; the loan-level price adjustment varies depending on the credit rating of the borrower.

Under the new proposal, homebuyers with credit scores above 680 would pay an additional $40 each month on a home loan of $400,000, while homebuyers who make down payments between 15% and 20% will receive the largest fees.